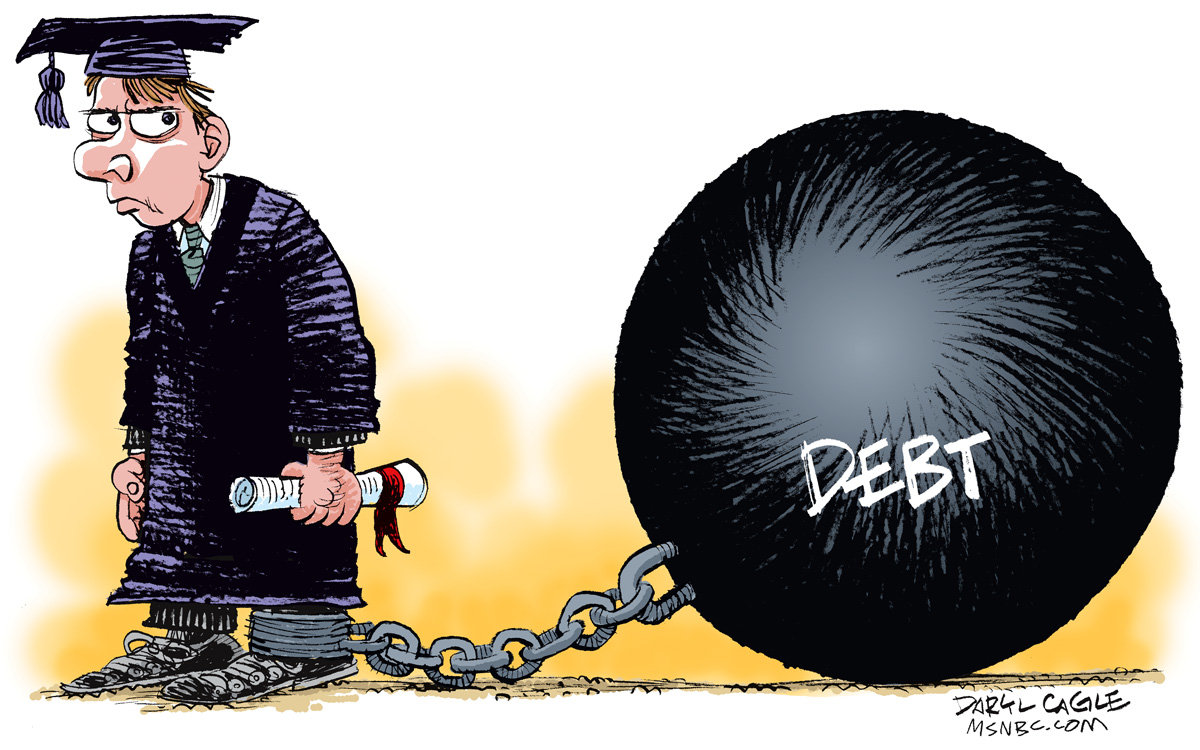

I Have Almost $40,000 In Student Loan Debt

There was never any question about whether or not I was going to go to college. It was just a given, from the time that I was in maybe 2nd or 3rd grade. I was smart and had always done very well in school, and college just seemed like a natural extension of that. I wanted to be a writer, and college was the place where I was going to hone those skills. When I graduated, I'd get a job writing or in publishing, and that would be that. Right?

Hahahahahahahahahahahahahaha.

Ha.

No.

I graduated pretty much at the peak of the recession, in 2009. No one was hiring, much less in publishing, which was already a dying industry. I felt so lucky to get any kind of a job at all, much less one that paid (slightly) more than minimum wage and offered at least the potential for advancement, but I was barely making enough money to pay my rent and bills. Sometimes I ended up eating nothing but Subway sandwiches or pasta for a week at a time because I had so little money for food. I diligently avoided thinking about my student loans, because I just didn't have the money to start paying them back.

Not thinking about them for the first year turned into not thinking about them for a couple of years. I was getting constant calls from debt collectors, which were easy enough to duck, but my nerves were fraying, and my heart would leap into my throat every time my phone rang. Then, suddenly, not thinking about it wasn't really an option anymore, because they started garnishing my wages.

I'm the first to admit that I'm not the most financially savvy person in the world, but I probably shouldn't have been as surprised as I was about it. Like, I owed $40,000. What the hell did I think was going to happen?

I'd always been really embarrassed about the amount of money that I owed and the poor choices that I knew I was making in not at least trying to pay it back, but that was nothing compared to the humiliation of having what felt like everyone at work know about it. The guy in the accounting department at work tried to be kind about it, but that's not really a blow you can soften.

Garnishment was awful, but in a lot of ways it was kind of a relief. Up until that point, it felt like the worst thing that could happen to me. Then it happened, and it sucked, but it wasn't the end of the world. There's only so much that they can legally take, so while it did make things even tighter than they'd already been, I found a way to manage.

Once I'd made a certain number of payments, I was able to get out of garnishment and refinance my loans. Now, instead of having several different companies that I owe, there are two. I was able to enter an income based repayment plan, which has been a real relief. The payments are low enough that I can make them without putting myself into financial hardship, which means that I can stick with it for the long haul.

One of my biggest financial goals for the next few years is to start paying off my loans a little bit faster. I've been playing catchup for so long it didn't really seem feasible, but I've realized recently that I do have quite a bit of extra money I could be putting towards that each month. Of course, there are other, more immediate goals that I should attend to as well - setting up a slush fund in case something happens to me, or to Brian - but knocking down some of that debt is really high on the list as well.

I'm doing a lot better financially than I was right after I graduated - old credit cards and other debt are mostly paid off or in the process of being paid off - but I'm going to have that sword hanging over my head for a long, long time (my repayment period is 25 years; there are people who pay off the mortgage on their houses in less time), barring some kind of miracle where I win the lottery and/or am adopted late in life by a millionaire.

It makes me a little bit bitter sometimes. I feel like there was value in getting my degree, and I don't know if I would have the job I have now without it, but it's just so much money. The school that I went to wasn't that expensive, as these things go, and I applied for and got several scholarships that covered about 1/4 of my expenses. I did have to take out a couple of personal loans (fun fact, the cosigner was the mother of my then-boyfriend, and you better believe I paid that shit off ASAP after we broke up), but they were really minimal, maybe $2000 total. It's kind of crazy that all I had to do was fill out a little paperwork, and all of a sudden there's just all kinds of FREE MONEY going right to my school, with little discussion of exactly how much money, or how I was supposed to pay it off.

Of all the classes that you have to take in college, shouldn't "How To Pay Off Your Student Loans Once You Graduate" be one of them? I guess caveat emptor or whatever, but at 18 I don't think I was really equipped to make that decision.

Anyone else struggle with student debt? How did you get yourself out of the hole? Or, if you're from a country that supports young people more than the USA, how weird does this entire story seem to you?